Are you planning to make a one-time investment in mutual funds or the Indian stock market? Use our Lumpsum Calculator to estimate your future investment value, total returns, and wealth growth in seconds! Whether you’re investing for a financial goal, retirement, or wealth creation, our lumpsum calculator is the perfect tool to help you make informed decisions.

Try out our monthly SIP calculator

Try Our Lumpsum Calculator Now!

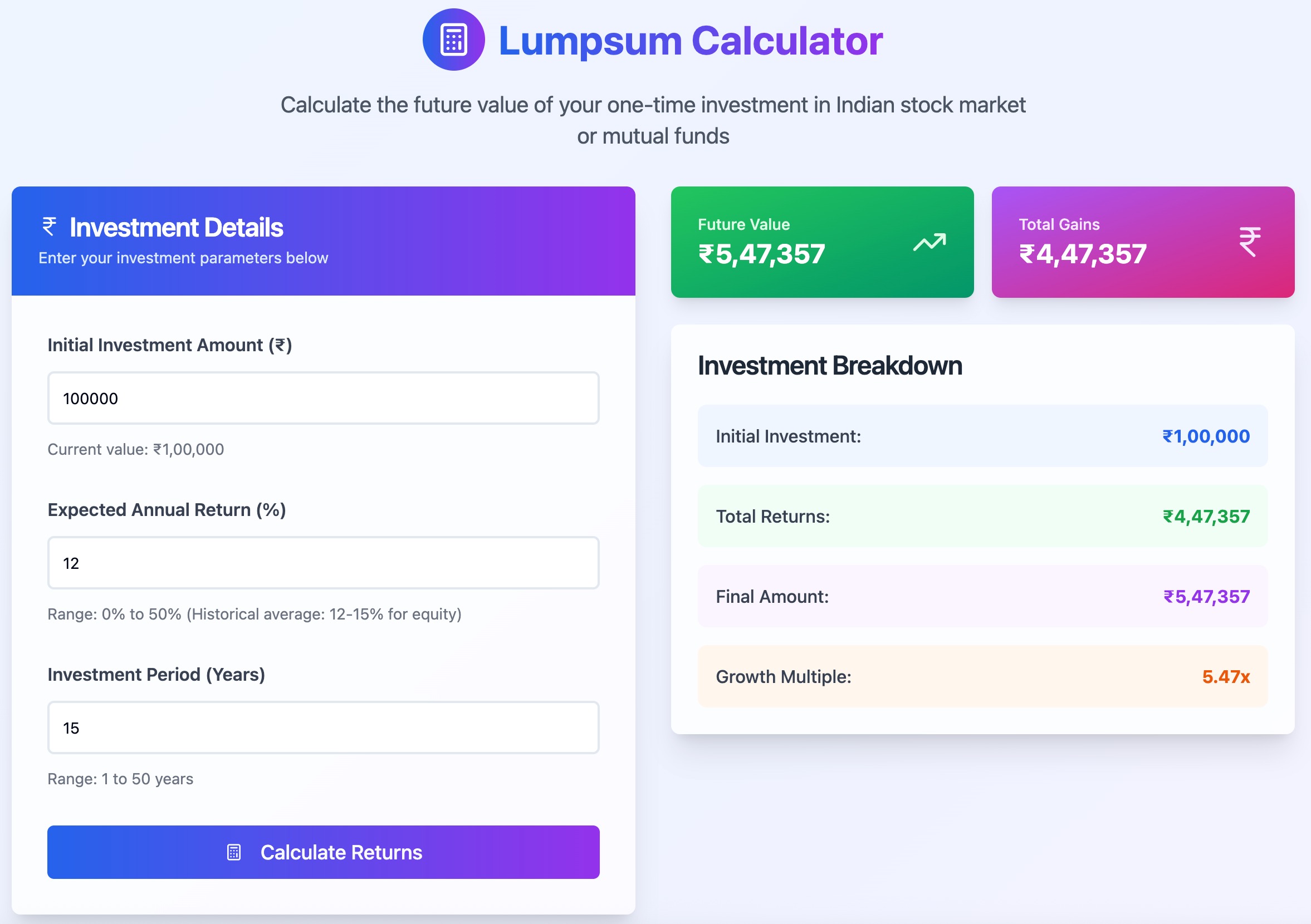

Ready to see how your one-time investment can grow? Use our interactive lumpsum calculator below to plan your financial future and achieve your goals.

What is a Lumpsum Calculator?

A Lumpsum Calculator is an online tool that helps you estimate the maturity amount and returns from a one-time investment in mutual funds or stocks. Unlike SIPs (Systematic Investment Plans), where you invest regularly, a lumpsum investment involves investing a large amount at once. Our calculator uses your investment amount, expected annual return, and investment period to give you an accurate projection of your wealth at maturity.

Try our FREE SIP Goal Calculator Online

How Does the Lumpsum Calculator Work?

Our lumpsum calculator uses the compound interest formula to project the potential growth of your one-time investment:

- Initial Investment Amount: The one-time amount you plan to invest, for example, ₹1,00,000.

- Expected Annual Return (%): The average annual return you anticipate. Historically, Indian equity mutual funds have yielded 12-15% per annum.

- Investment Period (Years): The total duration for which you plan to stay invested, ranging from 1 to 50 years.

Based on these inputs, the calculator displays:

- Final Amount: The total value of your investment at the end of the period.

- Total Returns: The profit earned over your principal investment.

- Growth Multiple: How many times your money has grown.

Why Use a Lumpsum Calculator?

- Accurate Planning: Know exactly how much your one-time investment can grow over a specific period.

- Goal Setting: Align your investments with life goals such as buying a house, children’s education, or retirement.

- Compare Scenarios: Experiment with different return rates and durations to find the best strategy for your needs.

- Instant Results: No complex calculations—get results instantly and make smarter investment choices.

Benefits of Lumpsum Investing

- Immediate Market Participation: Invest a large amount at once and benefit from market upswings.

- Compounding Effect: The longer your money stays invested, the greater the power of compounding.

- Simplicity: No need to remember monthly payments or set up recurring transfers.

- Ideal for Windfalls: Perfect for bonuses, inheritances, or large savings ready to be invested.

Example: Lumpsum Investment Calculation

Suppose you invest ₹1,00,000 as a lumpsum in an equity mutual fund with an expected annual return of 12% for 15 years. According to our lumpsum calculator:

- Initial Investment: ₹1,00,000

- Total Returns: ₹2,10,585

- Final Amount: ₹3,10,585

- Growth Multiple: 3.11x

This example shows how a single investment, left to grow, can multiply your wealth significantly over time.

Start Growing Your Wealth Today!

Harness the power of compounding with a smart one-time investment. Use our lumpsum calculator to project your future wealth, plan your investments, and move confidently towards your financial goals.

Frequently Asked Questions (FAQs) about Lumpsum Calculator

1. What is the minimum amount for lumpsum investment in mutual funds?

You can start with as low as ₹5,000, but higher amounts can yield more significant returns.

2. How does a lumpsum calculator work?

It uses the compound interest formula to project the maturity amount based on your inputs.

3. Are lumpsum investments risky?

Like all equity investments, lumpsum investments carry market risks. Diversifying and choosing long-term horizons can help manage risk.

4. Can I use the calculator for investments other than mutual funds?

Yes. The calculator is useful for any one-time investment where returns are compounded annually.