Are you planning to invest in mutual funds and want to know how much wealth you can create with a Systematic Investment Plan (SIP)? Use our SIP Calculator to estimate your investment returns, maturity amount, and total wealth gained over time. Whether you are a beginner or an experienced investor, our SIP calculator is a powerful tool to help you plan your financial goals efficiently.

Try Our SIP Calculator Now!

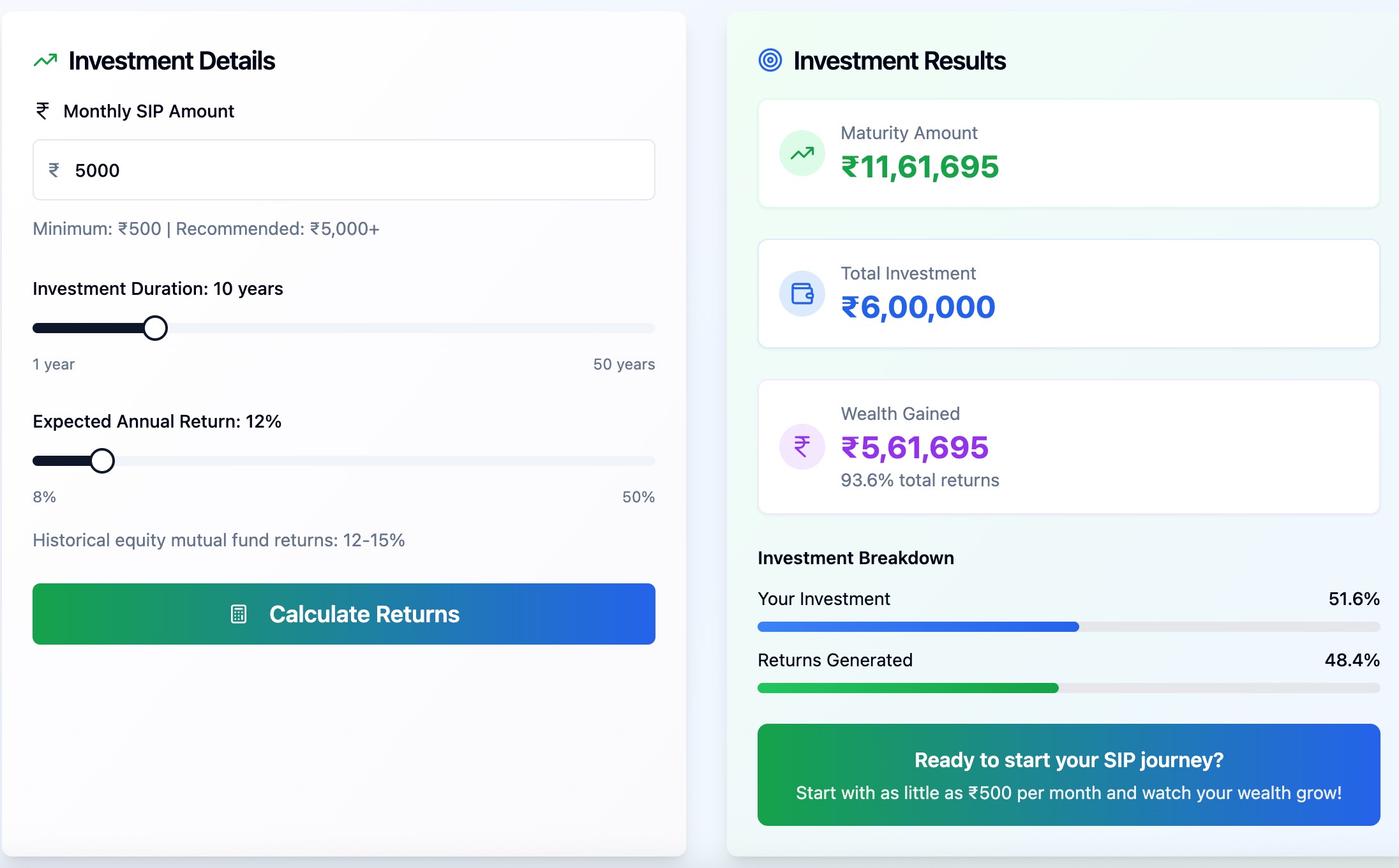

Ready to start your wealth creation journey? Use our interactive SIP calculator below to plan your investments and achieve your financial goals.

What is a SIP Calculator?

A SIP calculator is an online tool that helps you calculate the potential returns on your mutual fund investments through a Systematic Investment Plan. By entering the monthly SIP amount, expected annual return rate, and investment duration, you can instantly find out how much your investments will grow over time. This enables you to make informed decisions and strategize your investments to achieve goals like buying a house, funding your child’s education, or building a retirement corpus.

Check out the SIP Goal Calculator

How Does the SIP Calculator Work?

Our SIP calculator uses the power of compounding to estimate the maturity amount of your investments. Here’s how it works:

- Monthly SIP Amount: The fixed amount you invest every month. You can start with as little as ₹500 per month, but investing ₹5,000 or more is recommended for significant wealth creation.

- Investment Duration: The number of years you plan to continue your SIP. The longer you invest, the greater your wealth due to the compounding effect.

- Expected Annual Return (%): The average annual return you expect from your mutual fund investments. Historically, equity mutual funds in India have delivered returns between 12% to 15% annually.

With these inputs, the calculator computes:

- Total Investment: The sum of all your monthly investments over the chosen duration.

- Maturity Amount: The total value of your investment at the end of the period, including returns.

- Wealth Gained: The profit earned over your principal investment.

Why Use a SIP Calculator?

- Easy Financial Planning: Estimate how much you need to invest monthly to reach your financial goals.

- Visualize Wealth Growth: See how your money grows exponentially over time through compounding.

- Compare Scenarios: Adjust SIP amount, duration, or expected returns to find the best investment strategy.

- Goal-Oriented Investing: Plan for milestones like home purchase, children’s education, or retirement with confidence.

Benefits of Investing via SIP

- Disciplined Investing: Automate your investments and build wealth systematically every month.

- Rupee Cost Averaging: SIPs help you buy more units when prices are low and fewer when prices are high, averaging out your purchase cost.

- Power of Compounding: The longer you stay invested, the more your money grows due to compounding returns.

- Flexible and Convenient: Start, stop, or modify your SIP anytime as per your financial situation.

Example: SIP Returns Calculation

Suppose you invest ₹5,000 every month for 10 years at an expected annual return of 12%. According to our SIP calculator:

- Total Investment: ₹6,00,000

- Maturity Amount: ₹11,61,695

- Wealth Gained: ₹5,61,695 (93.6% total returns)

This example demonstrates how consistent investing, even with modest amounts, can help you accumulate significant wealth over time.

Start Investing Today!

Harness the power of compounding and systematic investing. Use our SIP calculator to take the first step towards financial freedom. Plan, invest, and watch your wealth grow!

You can also try: